Call Us

01202 849691

Whilst revenues and occupancy have been exceeding expectations for many operators in the hotel sector over the past 12 months, it is still critical to closely monitor the flow through of each unit of revenue to gross operating profit. Gross operating profits have been hit by the rising costs in the P&L including, food costs, payroll and utilities.The Uniform System of Accounts for the Lodging Industry defines the Gross Operating Profit as the profit achieved from all the property revenues less the departmental costs and the operational overheads known as the Undistributed Operating Expenses. The Gross Operating Profit is a measure of the contribution after departmental expenses made by the various revenue generating departments following the deduction of central costs including Administration and General Costs, Sales and Marketing, IT and Communications, and Utilities.

Therefore, it is a good measure of the overall potential of the business to generate an income for the owner as well as providing the basis for operating company management fees. Gross operating profit can be monitored using a range of measures, the cash value, the percentage to total revenue and as an asset usage ratio such as GOPPAR (Gross Operating Profit per Available Room) and GOPPOR (Gross Operating Profit per Occupied Room).

Flow Through is defined by the USALI as the difference between the actual GOP achieved versus budget or last year divided by the difference in actual total revenue and the budget or last year values.

Actual Gross

Operating Profit – Budgeted Gross Operating Profit

Actual Revenue –

Budget Revenue

This provides an overall percentage measure of the conversion of the additional revenue to GOP which can be tracked when revenue both declines and increases.

When both revenue and GOP has dropped, the USALI recommends that the Flex calculation be used.

Actual Gross

Operating Profit – Budgeted Gross Operating Profit

Actual Revenue –

Budget Revenue

This is an excellent start to monitoring the GOP conversion. The next step is to understand how the source of revenue impacts on the conversion. The conversion rate of rooms revenue is quite different to F&B revenue for example because of the proportion of marginal or variable costs involved to deliver the sale. Within the category of room sales, the additional revenue could arise through an increase in the Average Room Rate (ARR) or through an increase in occupancy or a combination of both.

Using standard costing techniques, it is possible to both split the revenue to determine the source of the change in revenues as well as calculating the additional cost likely to be incurred. We can start with the Sales Volume Variance which is the difference between the actual and expected occupancy, i.e the number of rooms sold and then multiplied by the budgeted average room rate. The purpose of this variance is to separate out the change in GOP arising from the number of rooms sold.Then if we consider the Selling Price Variance, this is the difference between the actual and budgeted average room rate, multiplied by the actual number of rooms sold. The following steps illustrate how this can be achieved in practice.

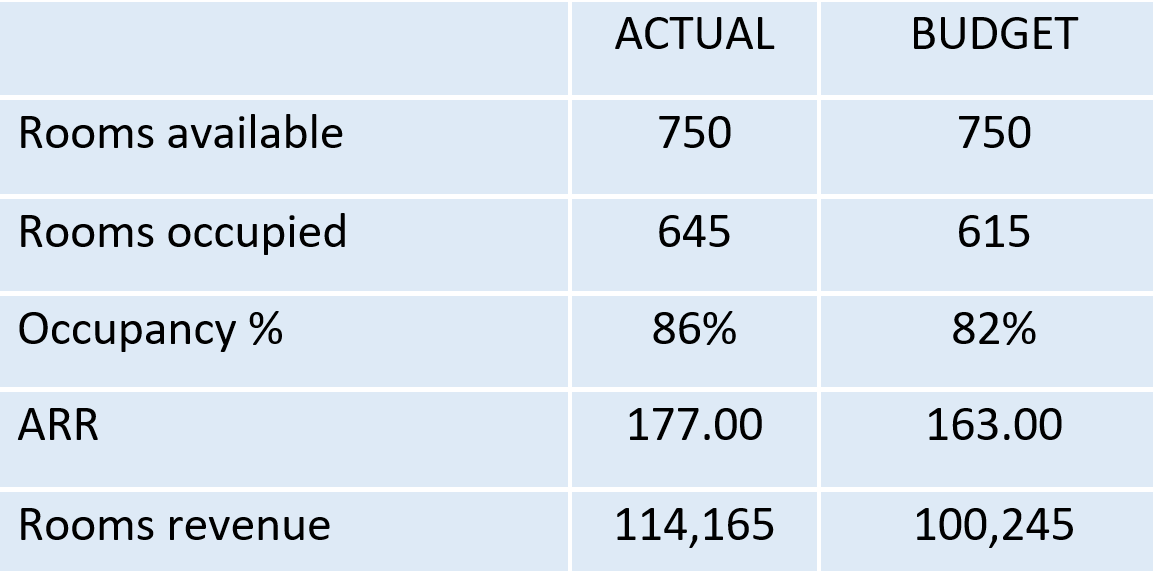

From the above table we can see that the additional total rooms revenue generated is £13,920. We can then split the increase in revenue into the two sources. The additional revenue due to the rooms occupied is:

30 X 163.00 = 4,890

And the additional revenue due to the average room rate is:

£14 x 645 = 9,030

We then need to consider what is the conversion rate of each of these sources of revenue to GOP. When additional rooms are sold there will be additional variable costs incurred to clean the rooms for example. Whereas an increase in room sales due to the rate change will have a higher conversion to GOP.

As in all analysis there are various assumptions to be made throughout the calculations which some might argue renders the review less useful. However, I would support the view that increased scrutiny provides increased insight and the process of completing the steps above provides a much-improved understanding of the true costs involved and the impact on the overall profitability of the business.

For more information on this topic visit arena4finance - YouTube or why not sign up for access to our online resources and receive certified evidence of your learning.

To learn more about these techniques why not join us for our next free webinar on the topic or sign up for one of our courses in 2023 /24 at arena4finance events

Photo courtesy of Edelle Bruton - Unsplash

Recent Articles

Back to newsIn November 2023, the UK Chancellor of the Exchequer, Jeremy Hunt, announced that the…

28 Nov 2023

Whilst revenues and occupancy have been exceeding expectations for many operators in the hotel…

15 Nov 2023

In support of two significant dates in the hospitality calendar, National Hospitality…

25 Sep 2023

Subscribe

Eager to learn more about our commercial acumen training solutions? Pop your email address in here and we will keep you updated!

We will never share or sell your personal data and we promise to keep your details safe and secure.